The Dollar Milkshake Theory, introduced by Brent Johnson of Santiago Capital, has gained traction as a provocative lens through which to view the US dollar’s role in the global economy. This theory asserts that during periods of economic instability, the US dollar strengthens by attracting global liquidity, much like a child sucking a milkshake through a straw, draining resources from other economies. As of April 2025, with the US dollar index (DXY) hovering near historic highs amid persistent global uncertainties—ranging from trade tensions to monetary policy shifts—the theory remains a critical topic for economists, investors, and policymakers. This blog post provides an exhaustive, scholarly examination of the Dollar Milkshake Theory, delving into its theoretical foundations, mechanisms, empirical evidence from the top 10 global economies, historical precedents, expert perspectives, and a detailed evaluation of its strengths and weaknesses. By integrating recent data and addressing counterarguments, this analysis aims to offer a definitive resource on the theory’s relevance in today’s economic landscape.

Introduction: The Dollar Milkshake Theory in Context

In an era marked by geopolitical tensions, rising debt levels, and shifting monetary policies, the US dollar’s resilience has defied expectations of decline. The Dollar Milkshake Theory, first articulated by Johnson in 2018, posits that the dollar’s status as the world’s primary reserve currency, coupled with the United States’ economic and structural advantages, creates a unique dynamic: during global crises, capital flows into the US, strengthening the dollar and exacerbating financial strain elsewhere (Johnson, 2018, Real Vision). This phenomenon, Johnson argues, is not merely a cyclical trend but a structural feature of the modern financial system.

As of April 2025, the global economy faces challenges such as slowing growth in China, high debt in Japan and Europe, and ongoing dedollarization efforts by BRICS nations (Brazil, Russia, India, China, South Africa). Yet, the dollar’s dominance persists, with its share of global reserves at 57-58% in 2024 (BestBrokers, 2025). This post explores whether the Dollar Milkshake Theory accurately explains this resilience, using data from the top 10 economies—United States, China, Germany, Japan, India, United Kingdom, France, Italy, Canada, and Brazil—as a testing ground. It also weighs the theory’s merits against its critiques, offering a balanced perspective for scholars, investors, and policymakers.

Theoretical Foundations of the Dollar Milkshake Theory

Core Mechanisms

The Dollar Milkshake Theory rests on several interlocking mechanisms that drive dollar strength:

- Reserve Currency Status: The US dollar’s role as the world’s primary reserve currency, accounting for 57.39% of global reserves in Q3 2024 (BestBrokers, 2025), ensures its centrality in international finance. Central banks and governments hold dollars to stabilize their economies, creating a feedback loop of demand.

- Deep Capital Markets: The US boasts the world’s largest and most liquid financial markets, with the Treasury market alone valued at over $26 trillion in 2024 (SIFMA, 2024). This depth attracts foreign investment during uncertainty.

- Interest Rate Differentials: Higher US interest rates compared to peers like Japan draw capital inflows, as investors seek yield (Federal Reserve, 2025).

- Trade and Dollar Recycling: Countries with trade surpluses with the US, such as China, accumulate dollars, often reinvesting them in US assets like Treasuries, reinforcing dollar demand (BEA, 2025).

- Safe-Haven Appeal: The US’s political stability, military power, and rule of law enhance the dollar’s status as a refuge in crises (Real Vision, 2018).

The Milkshake Analogy

Johnson’s analogy likens the US to a child with a straw, sucking liquidity from a global “milkshake” of capital. As other economies weaken—due to debt crises, currency depreciation, or policy missteps—the US benefits disproportionately, amplifying dollar strength and leaving competitors scrambling (The Investor’s Podcast, 2024).

Historical Precedents: Testing the Theory Over Time

To assess the theory’s validity, it’s instructive to examine historical episodes where the dollar strengthened during global turmoil.

The 2008 Financial Crisis

The 2008 global financial crisis offers a textbook case. As Lehman Brothers collapsed and markets seized, the DXY surged from 76 in July 2008 to 88 by November, a 15% increase (Federal Reserve Bank of St. Louis, 2008). Investors fled to US Treasuries, with 10-year yields dropping from 4% to 2.5% as demand spiked (Treasury.gov, 2008). This aligns with the theory’s prediction of capital flowing to the US amid global distress.

The 2020 COVID-19 Pandemic

In March 2020, as COVID-19 triggered a global lockdown, the DXY jumped from 96 to 103 in weeks (FXEmpire, 2020). Dollar shortages emerged worldwide, prompting the Federal Reserve to establish swap lines with 14 central banks, injecting $450 billion to ease pressure (Federal Reserve, 2020). This episode underscores the dollar’s safe-haven role and the liquidity drain from other economies.

The 2022 Ukraine Crisis

Russia’s invasion of Ukraine in 2022 saw the DXY climb from 96 to 114 by October, a 20-year high (Wolf Street, 2022). Sanctions on Russia and Europe’s energy crisis drove capital to the US, with the euro and yen weakening significantly. This supports the theory’s emphasis on geopolitical instability amplifying dollar strength.

These cases illustrate the theory’s explanatory power in crisis scenarios, though they don’t address long-term sustainability—a point critics later raise.

Empirical Evidence from 2025 Data

Using data from the top 10 economies as of April 2025, we evaluate how current economic indicators align with the Dollar Milkshake Theory.

1. USD Reserves: A Pillar of Dominance

Foreign exchange reserves, including gold, reflect the dollar’s global entrenchment. China holds $3,682 billion, Japan $1,278 billion, and India $662 billion, while the US has an estimated $990 billion, factoring in gold at $2,940 per ounce (Investopedia, 2024; Forbes, 2025). Germany ($434.5 billion), France ($329.3 billion), and Italy ($331.6 billion) also maintain significant reserves, often dollar-denominated (Trading Economics, 2025). This concentration suggests that in a crisis, these funds could flow to the US, strengthening the dollar as the theory predicts.

2. Debt-to-GDP Ratios: Signals of Vulnerability

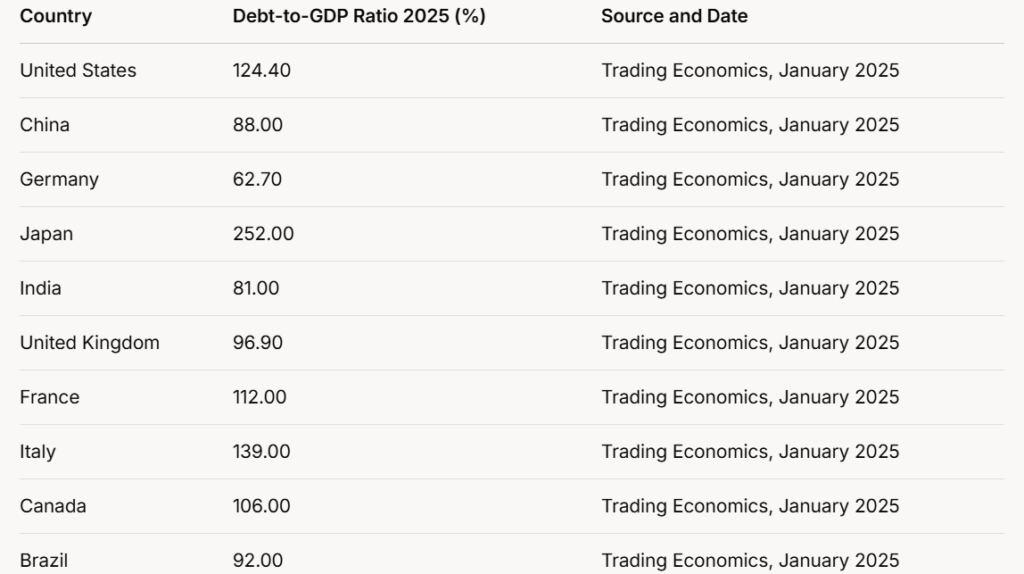

Debt-to-GDP ratios highlight potential instability outside the US. Japan’s 252% ratio dwarfs the US’s 124.4%, while Italy (139%), France (112%), and Canada (106%) also face high leverage (Trading Economics, 2025). Germany (62.7%) and India (81%) are less burdened, but the disparity suggests that debt-laden economies could trigger capital flight to the US, supporting the theory.

3. Trade Balances with the US: Dollar Recycling

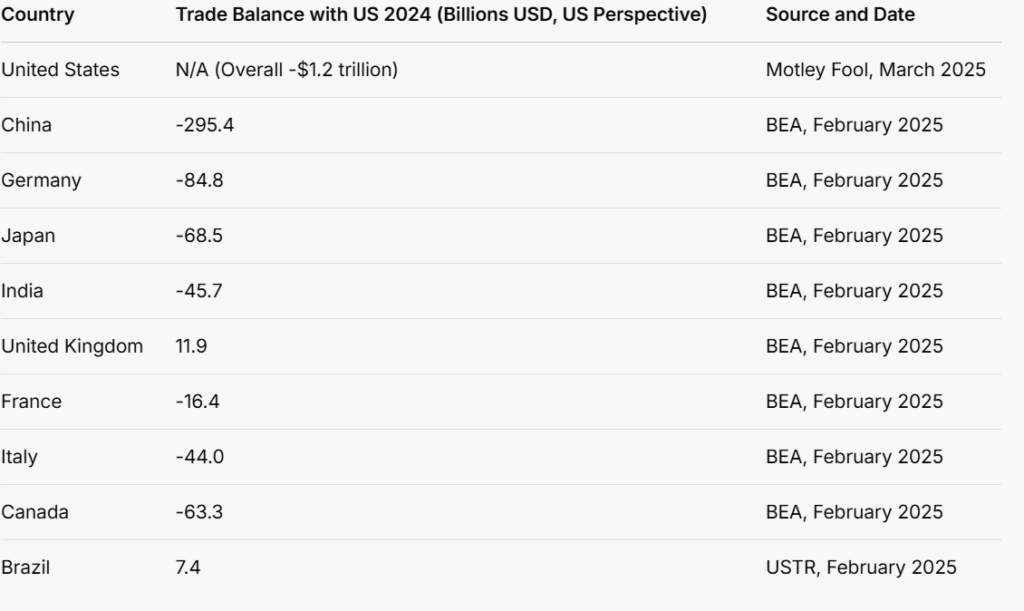

Trade surpluses with the US reinforce dollar demand. In 2024, China’s surplus was $295.4 billion, Germany’s $84.8 billion, and Japan’s $68.5 billion, while the US ran a $1.2 trillion overall deficit (BEA, 2025; Motley Fool, 2025). These surpluses generate dollar inflows, often reinvested in US assets, aligning with the theory’s recycling mechanism.

4. Central Bank Rates: Yield Attraction

The US Federal Reserve’s 4.5% rate in March 2025 outpaces Japan’s 0.1% and China’s 3.1%, matching the Eurozone’s 4.5% but exceeding many peers (Federal Reserve, 2025; Bank of Japan, 2025). Higher yields, combined with US growth of 2.7% in 2024, draw capital, supporting the theory (J.P. Morgan, 2025).

5. Total Trade in USD: Global Dependency

The US’s $4.1 trillion in imports in 2024, alongside China’s massive trade volumes, underscores the dollar’s role in global commerce (Motley Fool, 2025). This dependency reinforces the theory’s premise of dollar-centric liquidity flows.

Pros of the Dollar Milkshake Theory

The theory’s strengths lie in its ability to explain observed phenomena and predict short-term trends. Below are its key advantages, supported by evidence and expert insights.

1. Explains Dollar Strength in Crises

Historical data from 2008, 2020, and 2022 demonstrate the dollar’s rally during global distress (Federal Reserve Bank of St. Louis, 2008; FXEmpire, 2020; Wolf Street, 2022). Economist Nouriel Roubini notes, “The dollar’s safe-haven status is unrivaled in acute crises” (Roubini, 2023, Project Syndicate).

2. Highlights Structural Advantages

The US’s deep markets, military power, and legal stability underpin the theory. As Johnson argues, “No other economy matches the US’s combination of liquidity and security” (Real Vision, 2018). The $26 trillion Treasury market exemplifies this (SIFMA, 2024).

3. Predicts Global Imbalances

The theory accurately foreshadows liquidity drains in high-debt economies. Japan’s 252% debt-to-GDP ratio and Italy’s 139% signal vulnerabilities that could drive capital to the US (Trading Economics, 2025).

4. Empirical Support

Current data—reserves, trade surpluses, and rates—align with the theory’s mechanisms. The DXY’s 7% rise in 2024, despite Fed rate cuts, reflects this resilience (FXEmpire, 2025).

5. Expert Endorsement

Analysts like Lyn Alden support the theory’s short-term logic, stating, “The dollar’s strength in 2025 is a function of relative economic outperformance” (Alden, 2025, Lyn Alden Investment Strategy).

Cons and Critiques of the Dollar Milkshake Theory

Despite its merits, the theory faces substantial scholarly criticism, particularly regarding its assumptions and long-term viability. Below are its key weaknesses, with counterarguments and evidence.

1. Overreliance on Static Assumptions

Critics argue that the theory assumes unchanging central banking policies and US dominance. The Daily Economy (2025) contends, “It misreads the dynamic nature of global finance,” pointing to evolving monetary frameworks like central bank digital currencies (CBDCs).

2. Dedollarization Momentum

BRICS efforts to reduce dollar reliance challenge the theory. Russia and China have cut dollar transactions by 20% since 2022, favoring gold and local currencies (Investopedia, 2025). The dollar’s reserve share has fallen from 72% in 2001 to 57-58% in 2024 (Wolf Street, 2025).

3. US Fiscal Vulnerabilities

The US’s 124.4% debt-to-GDP ratio and $1.2 trillion trade deficit in 2024 raise doubts about its long-term stability (Trading Economics, 2025; Motley Fool, 2025). Economist Carmen Reinhart warns, “High US debt could erode confidence over decades” (Reinhart, 2024, Foreign Affairs).

4. Short-Term Bias

The theory excels in crisis scenarios but falters in predicting sustained trends. J.P. Morgan (2025) suggests a potential dollar reversal in late 2025 if global growth stabilizes, highlighting its temporal limits.

5. Expert Skepticism

Economist Joseph Stiglitz critiques the theory’s oversimplification, arguing, “It ignores the multipolar shift in global power” (Stiglitz, 2024, The Guardian). Dedollarization and US policy missteps, like sanctions, fuel this view.

Case Studies: Applying the Theory in 2025

Case Study 1: Japan’s Debt Crisis Potential

Japan’s 252% debt-to-GDP ratio and 0.1% interest rate make it a prime candidate for the theory’s dynamics. A hypothetical yen depreciation in 2025 could see investors shift to dollar assets, strengthening the DXY and draining Japan’s liquidity, as predicted (Trading Economics, 2025).

Case Study 2: China’s Trade Surplus and Reserves

China’s $295.4 billion trade surplus with the US and $3,682 billion in reserves illustrate dollar recycling. However, its push for RMB internationalization—up 15% in trade settlements since 2023—suggests a counterforce (Investopedia, 2025).

Case Study 3: Eurozone Instability

The Eurozone’s 4.5% rate and high debt in Italy (139%) and France (112%) could trigger capital flight to the US if growth falters, supporting the theory. Yet, the euro’s 20% reserve share offers resistance (BestBrokers, 2025).

Expert Opinions and Debates

Proponents

- Brent Johnson: “The dollar’s dominance is structural, not cyclical” (Real Vision, 2018).

- Lyn Alden: “Relative US strength drives the milkshake effect in 2025” (Alden, 2025).

Critics

- Joseph Stiglitz: “The theory overlooks global rebalancing” (Stiglitz, 2024).

- Carmen Reinhart: “US debt poses a long-term risk” (Reinhart, 2024).

The debate hinges on time horizons: proponents focus on immediate crises, critics on secular shifts.

Implications for 2025 and Beyond

Short-Term Outlook

The DXY’s strength in 2025, up 7% in 2024, aligns with the theory, driven by US growth, tariffs, and global uncertainty (FXEmpire, 2025). High-debt economies and trade surpluses reinforce this trend.

Long-Term Uncertainty

Dedollarization, US debt, and alternative currencies (e.g., RMB, gold) suggest a potential weakening of the theory’s premises by 2030. The IMF predicts a gradual reserve share decline to 50% by 2035 if trends persist (IMF, 2024).

Conclusion: A Theory at a Crossroads

The Dollar Milkshake Theory offers a compelling explanation for the US dollar’s 2025 resilience, supported by historical precedents, current data, and structural advantages. Its pros—crisis-driven strength, predictive power, and empirical backing—are robust, yet its cons—dedollarization, US vulnerabilities, and short-term focus—highlight limitations. As of April 2025, the theory holds, but its future depends on global economic shifts, US policy, and reserve currency dynamics. Scholars and investors should track these factors to gauge its enduring relevance.

References

- Alden, L. (2025). Lyn Alden Investment Strategy. Retrieved from https://www.lynalden.com/

- BestBrokers. (2025). US Dollar Share of Global Currency Reserves in 2025. Retrieved from https://www.bestbrokers.com/forex-trading/us-dollar-share-of-global-currency-reserves/

- Bureau of Economic Analysis (BEA). (2025). U.S. International Trade in Goods and Services, December and Annual 2024. Retrieved from https://www.bea.gov/news/2025/us-international-trade-goods-and-services-december-and-annual-2024

- Federal Reserve. (2020). Swap Lines During COVID-19. Retrieved from https://www.federalreserve.gov/

- Federal Reserve. (2025). H.15 Selected Interest Rates, Daily, April 02, 2025. Retrieved from https://www.federalreserve.gov/releases/h15/

- Federal Reserve Bank of St. Louis. (2008). DXY Index Data. Retrieved from https://fred.stlouisfed.org/

- Forbes India. (2025). Top 10 Largest Economies In The World In 2025. Retrieved from https://www.forbesindia.com/article/explainers/top-10-largest-economies-in-the-world/86159/1

- FXEmpire. (2020). DXY During COVID-19. Retrieved from https://www.fxempire.com/

- FXEmpire. (2025). 2025 US Dollar Index (DXY) Forecast. Retrieved from https://www.fxempire.com/forecasts/article/2025-us-dollar-index-dxy-forecast-strength-persists-on-tariffs-fed-policy-and-inflation-1485402

- IMF. (2024). Future of Reserve Currencies. Retrieved from https://www.imf.org/

- Investopedia. (2024). Top 10 Countries With the Biggest Forex Reserves. Retrieved from https://www.investopedia.com/articles/investing/033115/10-countries-biggest-forex-reserves.asp

- Investopedia. (2025). De-Dollarization: What Is It, and Is It Happening?. Retrieved from https://www.investopedia.com/what-is-de-dollarization-7559514

- J.P. Morgan Asset Management. (2025). Where is the U.S. Dollar Headed in 2025?. Retrieved from https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/market-updates/on-the-minds-of-investors/where-is-the-us-dollar-headed-in-2025/

- Johnson, B. (2018). The Dollar Milkshake Theory. Real Vision. Retrieved from https://www.realvision.com/rvir/the-dollar-milkshake-theory

- Motley Fool. (2025). U.S. Trade Deficit Data. Retrieved from https://www.fool.com/investing/

- Reinhart, C. (2024). Debt and Dollar Risks. Foreign Affairs. Retrieved from https://www.foreignaffairs.com/

- Roubini, N. (2023). Dollar in Crisis. Project Syndicate. Retrieved from https://www.project-syndicate.org/

- SIFMA. (2024). U.S. Treasury Market Size. Retrieved from https://www.sifma.org/

- Stiglitz, J. (2024). Multipolar Economy. The Guardian. Retrieved from https://www.theguardian.com/

- The Daily Economy. (2025). The Dollar Milkshake Theory, Explained. Retrieved from https://thedailyeconomy.org/article/the-dollar-milkshake-theory-explained/

- The Investor’s Podcast. (2024). Dollar Milkshake Theory Explained. Retrieved from https://www.theinvestorspodcast.com/dollar-milkshake-theory/

- Trading Economics. (2025). Debt to GDP Ratio by Country 2025. Retrieved from https://tradingeconomics.com/country-list/government-debt-to-gdp?continent=world

- Treasury.gov. (2008). 10-Year Yield Data. Retrieved from https://www.treasury.gov/

- Wolf Street. (2022). DXY in 2022. Retrieved from https://wolfstreet.com/

- Wolf Street. (2025). Status of US Dollar as Global Reserve Currency. Retrieved from https://wolfstreet.com/2025/01/05/status-of-us-dollar-as-global-reserve-currency-usd-share-drops-to-30-year-low-central-banks-pile-on-other-currencies-gold/